680億円――。大半の人にとっては気の遠くなるような金額の請求を、岡田和生氏個人が受けることになりました。2017年6月に経営騒動が表面化してから、はや2年半。ここにきて、ユニバーサルエンターテインメントグループから岡田和生氏へ、過去最大の“おしおき”です。――オトシマエ、ツケテモライマスヨ?

「680億円」の根拠は岡田和生氏の違法行為

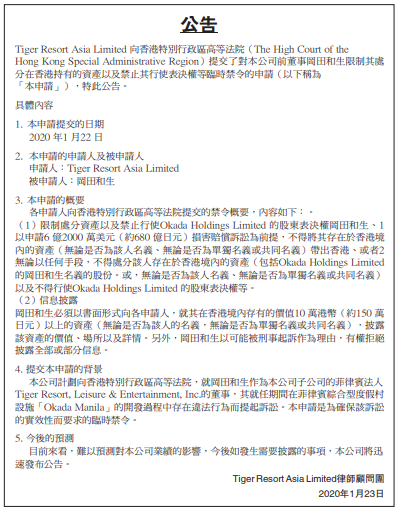

ユニバーサルエンターテインメントグループが岡田和生氏に対して、680億円という、とてつもない金額を請求する。この一大事は、香港の現地紙に掲載された一通の書面において明らかになりました。

この書面は、ユニバーサルエンターテインメントの子会社・Tiger Resort Asia(TRA)がまとめたものです。なかには、同社から香港の裁判所に対して、岡田和生氏に関する仮処分を求めた旨と、この仮処分に続けて提起する予定の訴訟について言及した文面があります。

まず問題の「680億円」が出るのは、書面の序盤あたり。

香港の新聞から

以申請6 億2000 萬美元(約680 億日元)損害賠償訴訟為前提

意訳:6億2000万米ドル(約680億円)の損害賠償請求訴訟を前提として

そしてこの書面には、訴訟の説明として、

香港の新聞から

本公司計劃向香港特別行政區高等法院,就岡田和生(kazuo okada)作為本公司子公司的菲律賓法㆟Tiger Resort, Leisure & Entertainment, Inc.的董事,其就任期間在菲律賓綜合型度假村設施「Okada Manila」的開發過程㆗存在違法行為而提起訴訟。

意訳:当社(=TRAのこと)は、香港特別行政区の高等裁判所に、訴訟を提起する計画です。フィリピンにある子会社・Tiger Resort, Leisure & Entertainment, Inc.の取締役に就いていた岡田和生氏が、統合型リゾート施設「オカダマニラ」の開発において、違法行為を働いていました。

との文面もあります。おそらく、ここでいう岡田和生氏の違法行為というのは、2019年の暮れに別の香港メディアが報じていた「オカダマニラに関する過剰な支出」のことです。680億円の請求は、この件を根拠にした損害賠償ということになるのでしょう。

| 公になった損害賠償請求訴訟のまとめ |

| 状況 | 管轄の裁判所 |

| まもなく提訴(仮処分申し立て中) | 香港特別行政区高等法院 |

| 原告 | 被告 |

| Tiger Resort Asia Limited | 岡田和生 |

| 補足説明 | |

| ユニバーサルエンターテインメントの子会社・Tiger Resort Asiaから岡田和生氏に、680億円の損害賠償を請求するもの。会社サイドは賠償請求の根拠として、「岡田和生による違法行為」を挙げている。現地の報道によれば、「オカダマニラ」の開発過程において、過剰な支出があったという。会社サイドから岡田和生氏に対して損害賠償を請求している訴訟はすでにいくつかあるものの、訴額がこれほどの規模にふくらんだ事例はほかにない。 | |

岡田和生氏は無視できないリスクに直面

ついでにふれておきますと、損害賠償請求訴訟に先立ってTRAが求めている仮処分の内容も、岡田和生氏にとってはなかなか強烈なラインナップです。

(1)限制處分資產以及禁止行使Okada Holdings Limited 的股東表決權

意訳:資産処分の制限および、株主議決権行使の禁止について不得將其存在於香港境內的資產(無論是否為該㆟名義、無論是否為單獨名義或共同名義)帶出香港

意訳:香港国内にある資産を、香港国外に持ち出してはならない(※対象資産は、岡田和生氏単独の名義であるか、共同名義であるかを問わない)。無論以任何手段,不得處分該㆟存在於香港境內的資產(包括Okada Holdings Limited的岡田和生名義的股份。或,無論是否為該㆟名義、無論是否為單獨名義或共同名義)

意訳:いかなる方法であっても、香港国内にある岡田和生氏の資産を処分してはならない(※対象資産は、岡田和生氏単独の名義であるか、共同名義であるかを問わない)。以及不得行使Okada Holdings Limited 的股東表決權等。

意訳:また、オカダホールディングスの株主議決権などを行使してはならない。(2)信息披露

意訳:情報開示について岡田和生必須以書面形式向各申請㆟,就其在香港境內存有的價值10 萬港幣(約150 萬日元)以㆖的資產(無論是否為該㆟的名義,無論是否為單獨名義或共同名義),披露該資產的價值、場所以及詳情。

意訳:岡田和生氏は、香港国内にある10万香港ドル(約150万円)以上の価値がある資産について、その詳細を申立人(=TRAのこと)に開示しなければならない(※対象資産は、岡田和生氏単独の名義であるか、共同名義であるかを問わない)。

これらの仮処分を裁判所が認めるかどうか、そこはわかりません。ただ、岡田和生氏からすれば、香港にある自分の資産がすべて凍結されるリスクというのは、決して無視できないものでしょう。

岡田和生氏が持つ金融資産のうち、価値の大半は、オカダホールディングスの株式が占めています。それに香港には、岡田和生氏個人の美術品管理会社・Okada Fine Artもあります。「とにかく節税」とばかりに、岡田和生氏はこれまであらゆる資産を香港に移してきたわけですが、そうした行いが、ここにきて裏目に出てきたといえるかもしれません。

なお、香港の法律では、裁判所が仮処分を命令を出した場合、それに従わないと投獄という展開もあるそうです。

香港大学 法科技術センター提供の法律情報ページから

如被告人違抗資產凍結令,可被處監禁。

意訳:資産凍結命令を無視した場合、被告は投獄される可能性があります。引用元:如何提出民事訴訟或作出抗辯

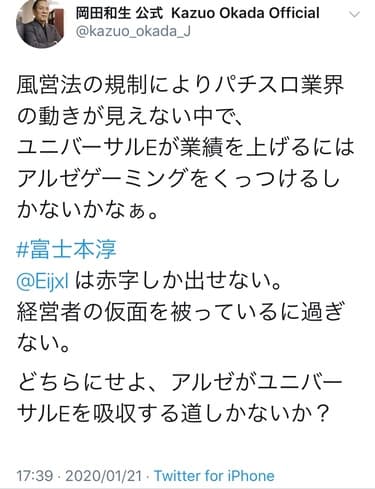

当の岡田和生氏といえば、最近はSNS上にふわふわとした絵空事を書きつづっていらっしゃるようですが、まずは目の前の現実と向き合ってみてはいかがでしょう?

※岡田和生氏の置かれた状況を考えれば、

「アルゼが吸収」なんて話は絶対に不可能なのです。

岡田和生氏に関連して、香港国内で起きた訴訟は、こちらにまとめています。

-

-

【地域別】ユニバーサルエンターテインメント関連訴訟相関図【香港】

ユニバーサルエンターテインメントおよび岡田和生氏に関連して、香港で起きた訴訟をここにまとめました。なお、掲載した情報は、現地の報道や開示書面、別件の訴訟のなかで明かされた話などをもとにしています。 ※ ...

![]()

にほんブログ村

社会・経済ランキング

いっそうの認知度向上のため、クリックをお願いします。